When you see a message saying "Waiting for a new entry point" it is because the buy criteria for this position are not satisfied.

For Channel Breakout

The required criteria needed to have an entry point in Channel Breakout are:

-

The 5 day condition(no any more since CS rule update)

-

The ADX going up (Blue)(no any more since CS rule update)

- The High price of the day is lower than the 55 day High value with buffer

- The Low price of the day is higher then the 20 day Low

For Trend Analysis

The required criteria needed to have an entry point in Trend Analysis are:

- The trend is Bull or Pennant

- The High price of the day is lower than the last swing High value with buffer

- The Low of the day is higher than the last swing Low

False breakout

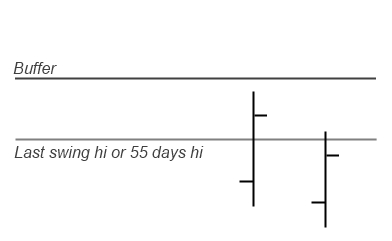

In the situation where the price is reaching into the buffer, what the market is telling us is that the stock price tried to climb above the last resistance and then fell back. In this case the entry point is still valid and you can place a buy order.

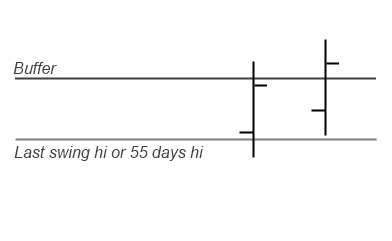

In the situation where the price is going above the entry price and finishes lower, what the market is telling us is that this may be a failed breakout (first candle of the image below). For those who had orders in the market, they were filled. For those looking to get in a day or more later, the stock is telling them that it doesn't know if it will keep climbing or if it will back off after this happened.

Therefore, a late entry where the entry price has climbed away from the original price is not the best entry and we are looking for another entry point.

If the high of the day is higher than the entry price, we have missed the entry point, therefore it is voided.